As of January 2026, Bali remains one of Southeast Asia’s most attractive real estate investment destinations. Fueled by a robust tourism rebound, the steady arrival of digital nomads and remote workers, and significant infrastructure improvements — such as airport expansions and enhanced connectivity — the island has transformed from a purely seasonal vacation destination into a serious, high-value asset class.

Real estate market trends 2026 show Bali’s market moving into a more mature stage: growing land scarcity in prime premium zones, rising focus on promising emerging areas offering better value, wider acceptance of flexible ownership models, and consistent demand for wellness-oriented, sustainable properties designed for extended stays.

What has driven growth so far

- Steady annual price increases of 7%+ in sought-after locations, supported by strong demand and limited new supply

- Strong rental yields from both short-term holiday rentals and the fast-growing segment of mid- to long-term leases by expats and remote professionals, especially in Canggu, Ubud, and Sanur

- Infrastructure progress opening up previously underdeveloped areas

- Clear buyer preference for eco-friendly designs, wellness features, and smart-home technology

Key directions defining 2026

- Greater accessibility through innovative structures: long-term leaseholds, right-to-use agreements, and fractional ownership, lowering barriers for international investors

- Shifting rental patterns, where longer stays (several months to a year or more) are becoming nearly as prevalent as classic vacation rentals

- New projects favoring compact 1–2 bedroom villas and apartments to provide lower entry costs and improved liquidity

- Tighter regulations on land usage, permitting, and sustainability requirements, likely to further restrict supply and bolster price appreciation in desirable locations

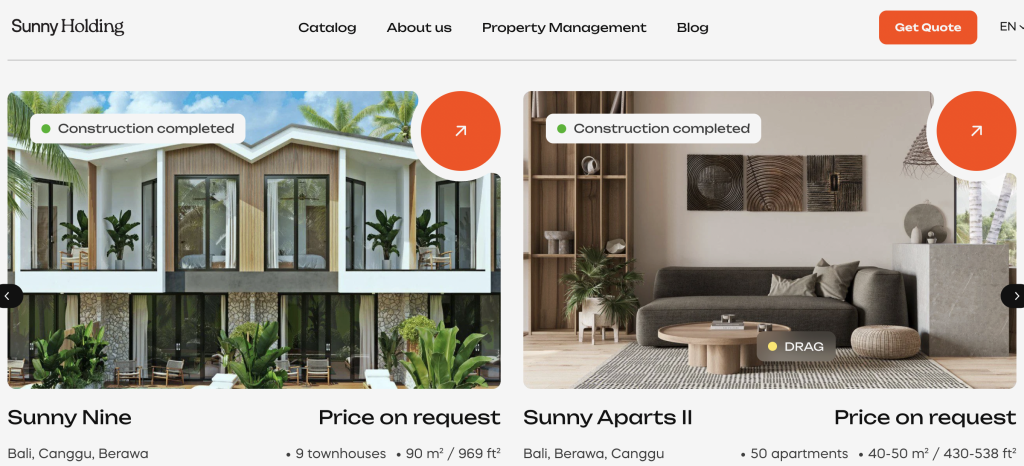

A developer that exemplifies these dynamics particularly well is Sunny Holding, through its specialized arm — Sunny Development Group (SDG).

Known for creating projects that merge exceptional elegance with demonstrated profitability, Sunny Development Group brings more than 13 years of specialized experience. Under co-founders Igor Grosu and Viktoria Halitska, the company has delivered every project on schedule and to top-tier standards, establishing itself as one of Bali’s most dependable players in a competitive field.

Their philosophy extends beyond standard construction — they prioritize inspiring, design-driven living spaces built to retain and grow value over the long term. Every project is strategically positioned as a high-yield investment, capable of delivering up to 12% annual returns thanks to intelligent design, efficient layouts, and solid financial underpinnings.

Standout projects in their Bali portfolio include:

- Sunny Cuddles, Sunny Samudra, and Sunny Family Ubud — contemporary residences that seamlessly integrate modern aesthetics with genuine Balinese touches, providing serene, family-friendly environments perfect for extended stays near beaches, schools, and everyday amenities.

- Rental-focused developments like Sunny Nine, Sunny Apart 1 & 2, and Sunny Muse — engineered for versatile short- and mid-term leasing, backed by full professional management for hassle-free operations and reliable returns.

- Sunny Wellness Spa — a high-end, resort-like sanctuary that aligns perfectly with the worldwide surge in wellness and health-focused lifestyles, centered on rest, renewal, and holistic well-being.

This successful formula is now expanding globally. Sunny Moon, a luxury project near the renowned Nai Harn Beach in Phuket, Thailand, replicates the same sophisticated design and strong return potential. Additional developments are in the pipeline for Portugal, extending the proven combination of outstanding aesthetics and attractive investment outcomes across international markets.

Why early 2026 remains a smart time to position yourself

Persistent supply limitations in core areas, alongside ongoing lifestyle and remote-work demand, continue to generate advantageous conditions. Investors who target quality projects, emerging zones, and reputable operators can still secure appealing entry prices ahead of the next appreciation wave.

Investor benefits at a glance

- Dual advantage of personal lifestyle enjoyment plus dependable financial performance

- Attractive yields in professionally managed assets

- Strong long-term capital appreciation driven by land constraints and global appeal

- Enhanced entry for foreign buyers via modern ownership structures

Risks to evaluate thoroughly

Complex foreign ownership rules (thorough due diligence required), possible oversupply in certain niches, dependence on worldwide tourism and economic conditions, and the importance of solid exit strategies in lower-liquidity segments.

Quick FAQ – Bali Real Estate in 2026

Is it already too late to enter the Bali property market?

No, not at all. The market is maturing and becoming more selective, but it is far from peaking. Land scarcity in core premium zones (Canggu, Seminyak, Uluwatu) is pushing value into emerging and value-driven areas (Pererenan, North Bali, parts of Tabanan, Nyanyi). New flexible ownership models and sustained structural demand from remote workers, wellness seekers, and longer-stay expats continue to open attractive entry windows — especially if you focus on quality projects and proven operators.

What rental yields are realistic in 2026?

Gross yields of 7–12%+ remain achievable in strong, well-managed locations (Canggu, Uluwatu, parts of Seminyak, Berawa), particularly for short- to mid-term rentals with professional management. In some premium or ocean-view setups, top performers still reach 12% gross (occasionally higher with excellent occupancy). Net yields are lower after realistic costs (maintenance, staff, marketing, taxes, platform fees, reserves) — typically landing in the 5–9% range depending on location and management efficiency. Emerging zones often start lower on yield but offer stronger capital growth potential.

Can foreigners legally buy property in Bali?

Yes — but freehold land ownership (Hak Milik) is reserved for Indonesian citizens. Foreigners access the market through secure, widely used structures:

- Long-term leasehold (Hak Sewa) — usually 25–50+ years with extension options

- Right-to-Use (Hak Pakai)

- Fractional ownership models (tokenized or shared via legal entities)

- PT PMA company setup (foreign-owned company that holds Hak Guna Bangunan title)

All of these provide strong legal rights to use, rent out, and benefit from appreciation. Always engage a reputable, experienced notary and lawyer specializing in foreign investment to ensure clean title, proper contracts, and tax optimization.

What are the biggest risks in the Bali real estate market right now?

The main ones to watch in 2026 include:

- Regulatory tightening or changes (land-use rules, permitting, sustainability standards, short-term rental restrictions in certain areas)

- Localized oversupply in weaker micro-markets or over-built pockets (some parts of Canggu/Seminyak saw this in 2024–2025, though construction has slowed)

- Management quality — poor operators can turn even great locations into low performers

- Global travel/tourism volatility and broader economic cycles

- Currency and exit liquidity risks in less mature segments

Thorough due diligence, choosing established developers/managers, and stress-testing numbers help mitigate most of these.

Do I have to manage the property myself?

No — far from it. Many high-quality developments (especially villas and boutique apartments designed for investment) come with turn-key professional management companies that handle everything: bookings, guest communication, cleaning, maintenance, marketing, pricing optimization, and legal/tax compliance. This allows truly passive ownership with monthly or quarterly payouts. Look for projects that partner with experienced operators — it usually makes a big difference in net returns and peace of mind.

How important is timing right now (early 2026)?

Still very advantageous. Supply in desirable zones remains constrained, while lifestyle migration (digital nomads, remote professionals, wellness seekers) and tourism strength persist. Securing a quality asset in a strategic location before the next appreciation cycle gains momentum can deliver both strong yield and capital upside. Waiting often means paying higher entry prices later.

Conclusion

In January 2026, Bali’s property sector is shifting toward a more selective and mature phase — yet the fundamental drivers (tourism resilience, remote lifestyle influx, infrastructure gains, and improved ownership flexibility) stay highly influential. For those who emphasize quality, well-chosen locations, and established developers, significant opportunities aligned with real estate market trends 2026 and remain available.

Komentar